A quick learning about the key rates that are often used by RBI to adjust liquidity, manage inflation and thereby regulate Indian Business economic environment.

This week on 04 May 2022, there was a big news in trend – After a long period of 2 years, RBI increased the Repo Rate by 40 bps to 4.40 percent making it same as it was in March 2020. Also RBI increased the Reverse Repo Rate by 40 bps to 3.75 percent making it same as it was in April 2020. These rates have been static for last 2 years since May 2020, when RBI had kept the Repo Rate at 4 percent and Reverse Repo Rate at 3.35%.

Repo Rate– When commercial banks finds shortage of funds (due to high demand of money in market), they turn towards RBI to borrow money. In such situation, RBI lend money to commercial banks @ Repo Rate (now 4.40 percent). Repo rate is kept higher in order to limit the liquidity in the market since cost of funds to the banks gets increased. This borrow-lend case is regulated through repurchase option or agreement when money is transferred at applicable repo rate.

Reverse Repo Rate- Reverse repo rate is just an opposite of Repo Rate. Here, when commercial banks have excess money due to fewer borrowers in the market, banks start lending money to RBI @ Reverse Repo Rate (now 3.75 percent). Reverse Repo Rate remains lesser than Repo Rate under normal situation.

MCLR- Marginal Cost of Lending Rate– Margin Cost (of funds-based) Lending Rate (MCLR) is the threshold lending rate below which a bank is normally not allowed to lend. It is a lending rate of interest for any bank or financial institution based on its marginal cost of funds and Repo rate decided by the RBI. MCLR stood at 7 per cent for overnight and one-month tenures, respectively, as of May 1st, 2022.

The benefit of MCLR fixation is:

- Transparency while determining their interest rates.

- Pass the benefits of reduced interest rates to customers.

- Ensure the funds/loans availability of loans to customers.

MCLR was introduced on 01st Apr 2016 and an option was given to all the borrowers to opt for availing MCLR benefit by shifting the loans taken before 01st Apr 2016. This new rate system ensures that lender don’t charge interest rate which is above margin specified by RBI. This applies only to loans taken under floating interest rate option.

The aim was to provide benefit to borrowers for RBI rate cuts. When RBI hikes the Repo Rates, MCLR also gets increased and hence it creates increase in ‘floating interest rate’ thereby increase in the EMI.

Under MCLR, it is mandatory for banks/financial institutions to declare overnight to 2-year interest rates every month.

Snapshot – Current MCLR Rates (as on 07 May 2022 of few Banks)

| Bank | 3-Years | 2-Years | 1-Year | 6-Months | 3-Months | 1-Month | Overnight |

| SBI | 7.30% | 7.20% | 7.00% | 6.95% | 6.65% | 6.65% | 6.65% |

| HDFC | 7.40% | 7.30% | 7.20% | 7.05% | 6.95% | 6.90% | 6.85% |

| AXIS | 7.55% | 7.50% | 7.40% | 7.35% | 7.30% | 7.20% | 7.20% |

| INDUSIND | 8.95% | 8.90% | 8.60% | 8.50% | 8.35% | 8.30% | 8.25% |

How does these rates (Repo, Reverse Repo, MCLR) affect people of India?

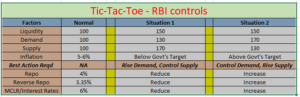

With the help of these rates, RBI regulate the liquidity in the economy. High liquidity if remains for a longer period sometimes increases the inflation and lower liquidity in the market for a longer period decreases the inflation. To manage this situation, RBI holds monetary policy meetings on regular basis so that money supply is regulated in favor of the country and its people.

No one wishes to have higher or even lower inflation for a longer period of time. RBI keeps assessing the situation of money supply and inflation and does necessary adjustments by way of change in key rates such as Repo Rate and Reverse Repo Rate. These rates have direct impact on the cost of borrowings or cost of funds held with banks that lends further to the people.

Increase in Repo rate increases the cost of funds for banks and thereby forcing banks to increase the MCLR which is nothing but marginal cost of lending rate. When MCLR is increased, interest on loans extended by bank to people gets increased i.e. EMI gets higher. Similarly, it works opposite way as well. EMI gets lower when MCLR is reduced due to lower cost of funds to banks i.e. when banks are able to borrow money is lesser rate of interest.